The Greensheet is Fusion Worldwide's monthly market intelligence report detailing the most significant developments across the integrated circuit, central processing unit, and hardware commodity supply chains. Here are some key takeaways from our latest report:

- High-bandwidth memory (HBM) is driving significant changes in the memory market, with manufacturers like Micron and SK Hynix selling out their product capacity for 2024.

- Supply constraints and upgrade hesitations shape the market for Intel processors.

- HDD supply is extremely limited due to production cuts, driving prices up, while SSD supply remains steady but with rising costs.

The memory, processor, and storage markets are experiencing significant shifts due to varying demands and supply constraints. Manufacturers are also preparing to navigate a changing landscape due to updates to U.S.- China tariffs, which will be phased in over the next three years.

Learn more about the market happenings in the full report below.

Demand for high-density D4 and D5 memory modules has expanded significantly over the past several months. The availability of D4 modules is declining as manufacturers pivot production to support D5 and HBM, which are the most profitable products. With availability expected to continue dropping, customers are building buffer supply.

Demand continues to expand in the HBM memory market, and 2024 product capacity for manufacturers like Micron and SK Hynix have already sold out, with 2025 quickly depleting. As more manufacturers prioritize HBM, the market will likely see an uptick in D5 pricing since HBM directly competes with D5 production. These products often share fabrication processes, and since HBM requires three times the number of wafers, the availability of D5 will likely decline as resources focus on support for the more in-demand and profitable HBM.

Micron and Samsung are among those increasing their HBM offerings and planning to pivot production capacity to support these new products.

Prices for LPDDR5 are also on the rise alongside SSD and DRAM module costs and will increase by another 10% to 15% this quarter. DRAM is at the higher end of price forecasts, and projections indicate that costs could reach 20% higher. Alternatively, low-density LPDDR4 is experiencing a decline in demand, and prices are decreasing.

Hardware

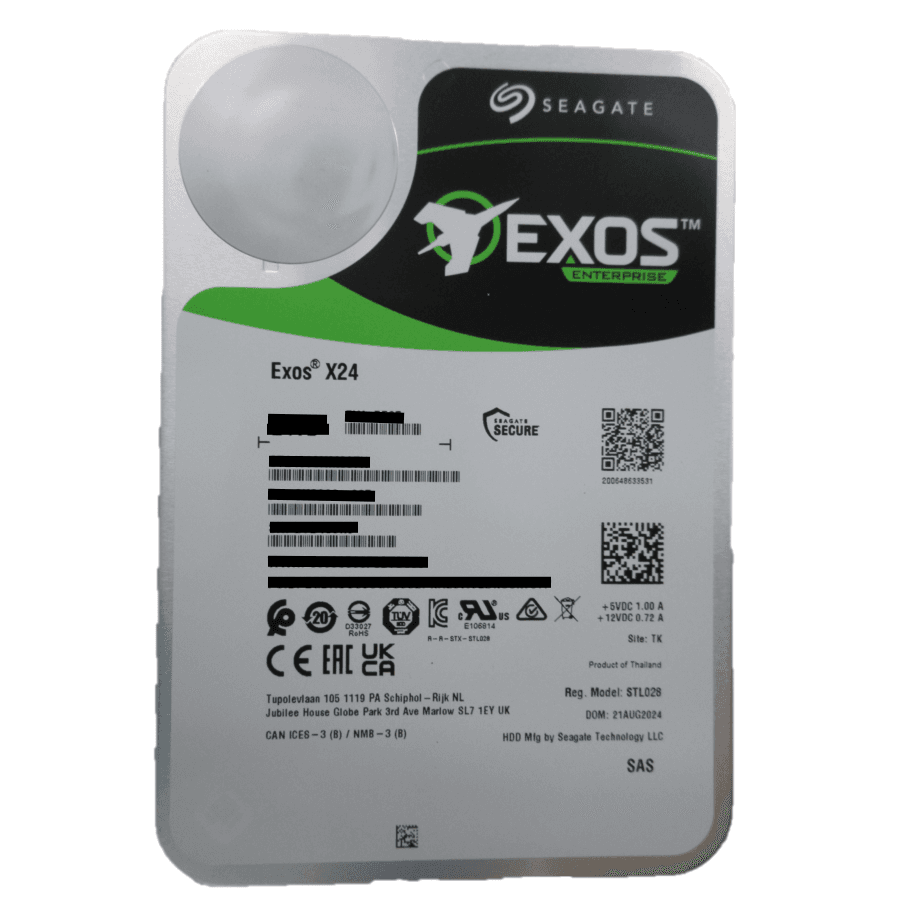

HDD Production Cuts Lead to Scarce Allocation, SSD Supply Stays Steady

HDD supply is extremely limited as market activity has increased tremendously since mid-April. This trend resulted from HDD production cuts as manufacturers attempted to reduce losses amidst the added pressure of material constraints.

The most impacted products are high-capacity HDDs 16TB and above, as vendors report allocation is limited and delivery dates are being pushed out. Prices have increased by eight to ten percent alongside the demand increase, and costs may rise further if demand remains constrained. Alternatively, low-capacity HDD supply remains very healthy.

Market demand for SSDs remains flat as allocation has normalized. While some reports of high-capacity SSD supply constraints still exist, most vendors report that allocation has been consistent. Pricing continues to rise despite the stability, and Q3 costs have already increased by five to ten percent.

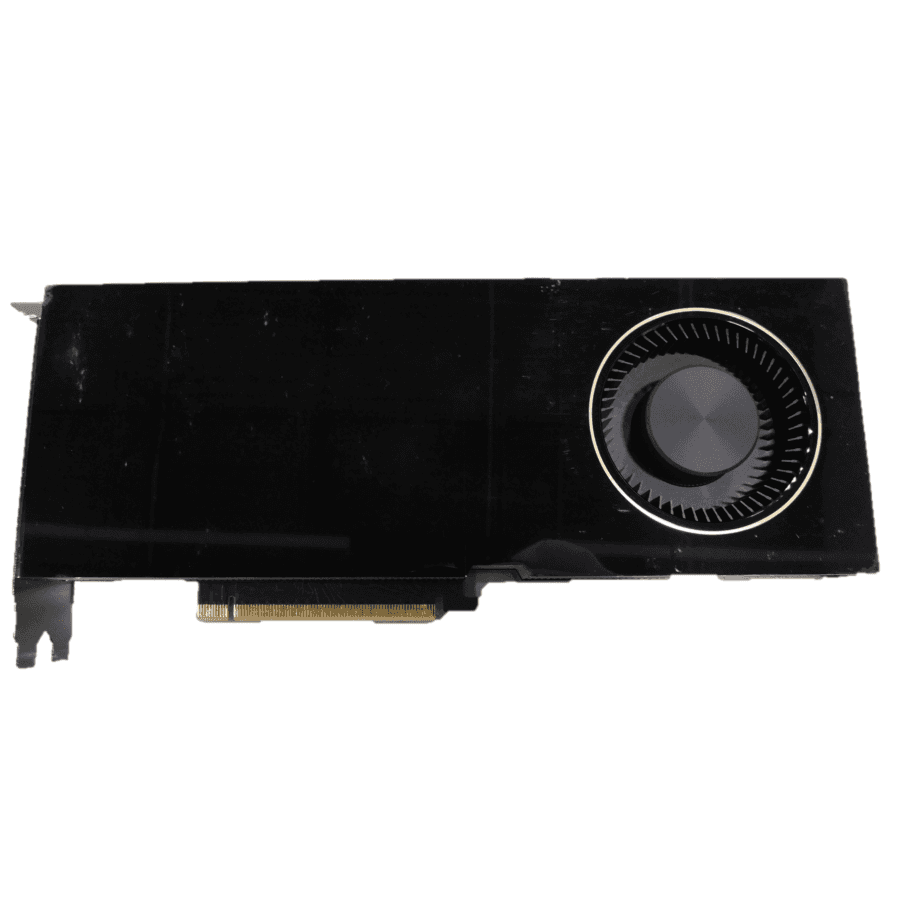

U.S. Tariffs on Chinese-Made Products Expected to Influence GPU Demand

AI GPUs continue to lead demand trends, with pricing and availability for the RTX 40 series and the A100 and H100 remaining high as supply continues to be limited. Alternatively, workstation GPU demand has stayed flat. Manufacturers hope that upcoming price adjustments will provide a much-needed boost.

Furthermore, the GPU tariff exemption for companies importing products from China to the U.S. ended on May 31st. The updated tariffs, which will go into effect in 2025, are expected to impact demand as costs have increased. Based on this development, inquiries for the RTX 40 series are already forecasted to increase.

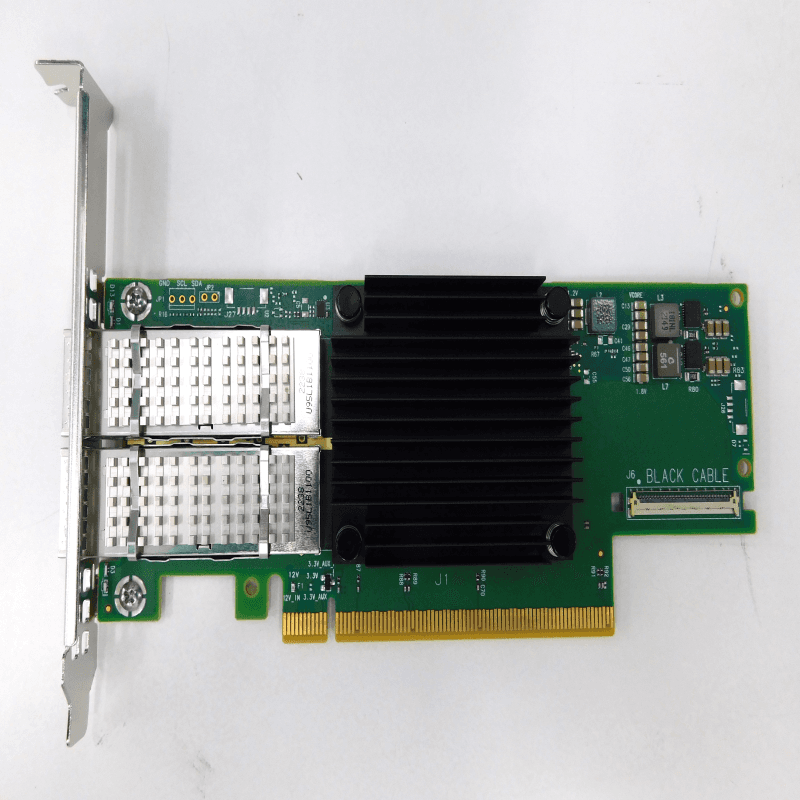

Networking Product Demand Holds Steady

Networking product demand remains high, especially for higher-end NICs, optical transceivers, cables, and switches. Mellanox is one of the manufacturers experiencing shortages for certain series of high-performance network adapters and NICs. Prices have increased for the MXC7 series alongside rising demand, and lead times are around eight weeks.

Mellanox is slowly reducing production of the MCX6 series in the second half of the year to prioritize capacity for the in-demand MCX7 series. Due to this development, there is little to no allocation for the MCX6 series.

Constrained Availability Continues for Intel Meteor Lake H Series

The supply constraints surrounding Intel’s Meteor Lake H series continued this month, with Tier 1 customers still bearing most of the impact. The Core Ultra 7 processor 165H and Core Ultra 9 processor 185H are experiencing the worst constraints amongst the other H series.

While spot supply should improve later this month, the constraints may persist into Q3. Supply may become further constrained if the series sees a higher adoption rate among non-Tier 1 customers.

Chromebook and Notebook Demand Drives Activity in the CPU Market

The uptick in Chromebook demand is causing a similar surge in activity for Intel’s ATOM CPUs. This trend stems from the growing adoption rate in the education sector and is leading to a concentrated interest in CPU N5095, N4500, and N100.

While the market is not experiencing significant shortages yet, some customers express concern about future availability because these CPUs are a low-profit product and, therefore, a low priority for manufacturers.

For AMD, market demand is rising for the recently launched Ryzen Pro 8040, which serves the commercial notebook segment. This product brings AI applications to commercial PCs and directly competes with Intel’s Ultra Core family in terms of AI processing capabilities.

Supply Constraints and Upgrade Hesitations Shape Intel Processor Trends

Market demand remains heavily focused on the 3rd Gen Ice Lake and 4th Gen Sapphire Lake. While interest in the 2nd Gen Cascade Lake is fluctuating, some potential supply constraints are on the horizon for items like the Gold 5220R, Gold 6238R, and Gold 6248R. However, this depends on how forecasts match up with true demand and is, therefore, subject to change.

Customers also hesitate to upgrade from Intel’s 4th Gen Sapphire Rapids to the 5th Gen Emerald Rapids Xeon Scalable processors, which is coloring demand forecasts. The reluctance stems from pricing concerns, as the 5thGen Emerald Rapids carries a 20% price premium despite utilizing the same motherboard platform. Customers may also be waiting until the 6thGen Granite Rapids launches next year, as these promise significant performance gains, potentially doubling core count, and cater specifically to AI and scientific computing applications.

Lead Times Expand for AMD Milan

Market sources indicate that supply is tight for EPYC 7763, 7713, and 7713P from the Milan series. Lead times are up to at least 24 weeks, and forecasts report prices will trend upwards throughout June as availability dwindles.

AMD’s EPYC Genoa-X series is experiencing a similar upside in demand and, therefore, tighter supply. Impacted products include the EPYC 9684X and EPYC 9384X.