CPUs

Pat Gelsinger returns to Intel

Intel has announced that Pat Gelsinger will be replacing current CEO, Bob Swan, on Feb. 15. Gelsinger has already stated the company will not be outsourcing the production of nodes to TSMC and will instead work with external foundries to become the leader in process technology.

All eyes will be on the new CEO to return Intel to its former glory days and overcome the CPU market share gains AMD has made.

Tiger Lake mobile CPUs shortage imminent

Suppliers have shared that there is limited Tiger Lake mobile CPU allocation from Intel, especially for non-Image Processing Units (IPUs). Based on the ongoing substrate shortage, customers are preferring that Intel focus on producing one product in the Tiger Lake mobile CPU series rather than juggling between both.

As the situation unfolds, we urge customers to stock up on non-IPUs before supply completely dries up in the open market.

Intel pushes for the transition of its desktop CPUs

Word on the street is that Intel has removed rebates on its 9th Gen Coffee Lake desktop CPUs to speed up the transition to its 10th Gen Comet Lake desktop CPUs. This should come as no surprise as Intel sent out an end-of-life notice on both Coffee Lake’s desktop CPUs and chipsets in early December 2020.

Additionally, due to ongoing restrictions and enterprise employees continuing to work from home, customers using the 10th Gen Comet Lake desktop CPUs may extend its use, foregoing 11th Gen Rocket Lake and jumping to Alder Lake when released. It is likely that because of this, 11th Gen Rocket Lake desktop CPUs and 500 series desktop chipsets will end up short-lived. This, of course, will lead to a new desktop motherboard requirement, which will be introduced as well.

With Intel’s 9th Gen Desktop CPUs discontinuing on June 25, 2021, we urge customers using them in current projects to acquire supply in the open market now before pricing rises further or supply dries up completely. We also suggest that while there’s still availability in the open market, customers evaluate their forecasts to ensure demand is met for the 10th Gen Comet Lake desktop CPU.

Intel announces end-of-life for 300 series

Intel has given the last product discontinuance order date for its 300 series desktop chipsets as July 23, 2021. Those included in this notice are listed below:

GL82Z370 SR3MD MM# 959538

FH82H370 SR405 MM# 964247

FH82Z390 SR406 MM# 964256

FH82B360 SR408 MM# 964265

GL82H310C SRCXT MM# 978315

GL82B365 SREVJ MM# 985926

FH82H310D SRFE1 MM# 999DZN

Supply constraint on Intel’s 400 series desktop chipsets

As customers continue to transition to the 10th Gen Comet Lake desktop CPUs, demand for Intel’s 400 series desktop chipsets and motherboards will ramp up due to its compatibility with Comet Lake. According to sources, Intel has recommended its motherboard partners order more B460 and H410 products because of an impending supply constraint, which could last throughout Q1 2021.

Suppliers are also seeing a tight supply of 400 series Comet Lake desktop chipsets. If customers intend to continue using 10th Gen Comet Lake desktop CPUs, we urge them to act now and purchase these 400 series chipsets as soon as possible.

AMD announces its new CPUs at CES 2021

AMD officially announced the release of its Ryzen 5000, Zen 3 Cezanne and Zen 2 Lucienne mobile CPUs at CES 2021.

The company also announced its 3rd Gen EPYC server CPU, Milan, which is expected to come into the market as early as end-of-March. While gaining market share in the desktop and mobile landscapes, AMD’s goal has been to challenge Intel’s stronghold in server space through the release of its EPYC server CPUs.

Despite AMD’s traction, these releases may be hindered by constrained capacity. It is unsure whether AMD can keep up with the overwhelming demand because of its limited capacity and ABF substrate issues.

In addition, the company plans on unveiling the laptop version of its Radeon RX 6000 RDNA 2 GPUs later in the first half of 2021.

ICs

MCUs face rising costs and lead times due to automotive demand

A majority of microcontroller manufacturers announced their updated pricing plans in December, effective Jan. 1. Three key players, STMicroelectronics, NXP and Renesas, increased pricing by a minimum of 10% across their product lineups.

Prices for Renesas’ legacy series products were also increased. Renesas cited the increased costs of raw materials and inventory holding, longer lead times for materials and government restrictions as causes for the price adjustments.

In addition, distributors are already noting extended standard lead times growing to 30+ weeks across the board. STMIC’s 32-bit MCUs (ST32 series), for example, have experienced lead time stretches since Q3 2020. In addition, supply for 16-bit and 32-bit MCUs has worsened because of the increased automotive demand ramping up in Q4 2020. Finally, the MCU shortage is now affecting more brands and series, including NXP’s MC56F8, MC9S08, MCF5, MCIMX6, FS32K and SPC56 series.

NXP distributors specified that 2000 of its products with increased pricing belong to automotive applications alone. As a result, current lead times for its automotive-related series range from 30-50+ weeks. Supply is not expected to improve in Q1 2021 but may bounce back in Q2, given there are no further issues with wafer allocations.

Many are also sharing that they expect another round of price increases in March 2021, including on Intersil’s legacy ISL series.

CMOS sensor market to see further growth

In recent news, Samsung, one of the biggest CMOS market shareholders, plans on converting one of its DRAM fabs into a CMOS image sensor line this year, potentially ramping up its production capacity by roughly 20%. In response, Sony is now planning to scale up its market share to 60% within the next five years by investing JPY$100 billion into its Nagasaki production line.

The CMOS image sensor market is expected to expand dramatically within the next few years from growing demand in consumer products (premium mobile phones now incorporate at least 3-4 cameras per phone), automotive segments and the robotics industry. As such, market predictions are pointing towards an uptrend in the coming quarters and beyond.

Moving forward, the increased need for mobile CMOS will lead to a USD$7.3 billion growth in sales within the next 3-4 years. By 2030, the sensor market will account for USD$143 billion in revenue.

Growing automotive demand puts strain on supply

In addition to strong demand for gasoline-powered vehicles, the electric vehicle (EV) market continues to grow, putting additional pressure on the supply of automotive-related components. EVs typically require more electrical components than gasoline counterparts because of its additional electrical systems and more advanced electronics.

Advanced Driver Assistance Systems, for example, are designed to avoid collisions, making it more sophisticated and complicated in EVs compared to gasoline-powered vehicles. Because of this, more electronic components are needed. Demand for discrete power devices and memory devices, in particular, are seeing the strongest growth due to the ongoing use of MOSFET and IGBT in automotive applications.

Moreover, the COVID-19 pandemic continues to affect the stability of global supply chains. Alps Electric’s electronics factory in Dalian, China, which produces components heavily used in automobiles and accounts for 25% of the company’s overall production, was shut down on Dec. 22, 2020, due to potential a COVID-19 exposure. It is unclear on when the factory will re-open.

Furthermore, the company’s Malaysia production was also recently affected by new government lockdowns in response to the growing number of COVID-19 cases. Due to this, distributors have been reluctant to accept new orders as they are unable to provide estimated delivery dates.

Orders placed in 2020 are mostly expected to be delivered by April; however, some could be pushed out further.

MEMORY

DRAM shortages to continue throughout 2021

In the last Greensheet, Fusion Worldwide reported numerous supply issues in the memory market, namely the shortage of DDR3 and low-power DDR4 DRAM chips. Since then, both DRAM and DIMM markets have heated up significantly. Now, there are supply shortages and price increases in multiple product groups that are not just affecting Samsung, Micron and Hynix, but smaller manufacturers, such as Winbond and Silicon Labs, as well.

Supply for DDR3 chips has become tighter as production capacity continues to shift toward DDR4 chips. With 5G rolling out in more markets across the globe, demand for memory chips will only continue to increase due to the network having much higher flash/memory requirements.

The DRAM shortage is expected to continue into Q2 and quite possibly into Q3 or Q4. Samsung has instructed some vendors to hit pause on taking orders as the company is already struggling to fulfill current orders. To combat this issue, Samsung is working with its customers to delay some deliveries to Q2 while outright canceling others.

DIMM demand struggles to be met

The DRAM shortages have trickled into the DIMM market with the entire range of memory modules facing tight supply. Some vendors are receiving less than 50% of their allocation for Q1, driving customers to the open market in search of supply. Many companies have also been trying to prepare for anticipated reduced allocations in February by securing stock ahead of the Chinese New Year.

After the holidays DIMM demand increased by 30%, causing open market prices to rise 5-10% for 32GB RDIMMs, which is most sought after by enterprise customers. With AMD preparing to launch its 3rd generation EPYC Milan CPUs in April as a strategy to overcome Intel in the server segment, additional pressure is being added to the highly constrained server DIMM supply.

There is already more DIMM demand than current production can satisfy, and a recovery in supply isn’t expected anytime soon as new production capacity will take significant capital and time. Samsung, for instance, will require two to three years of time and $2B in capital investment to be able to add any capacity that could materially affect market supply.

In short, market constraints will not be resolved in the short-term and prices are almost certain to continue rising in the coming months.

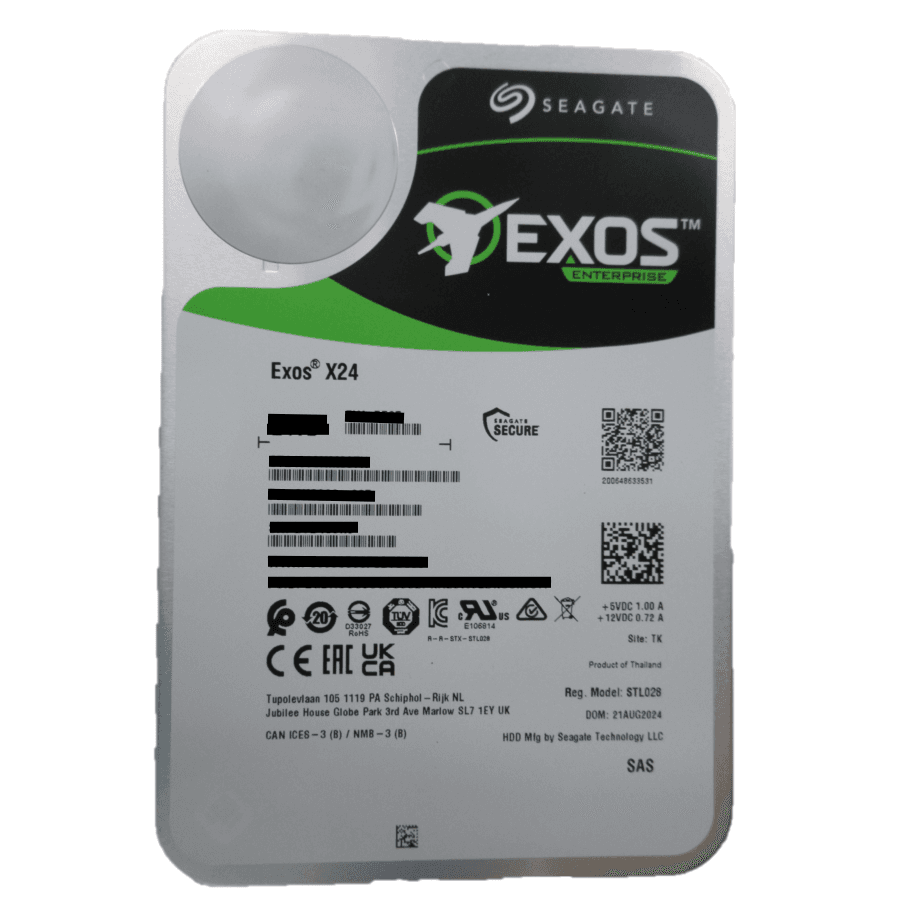

STORAGE

SSDs expected to experience drastic growth

The global SSD market is predicted to increase at a quick pace within the next 4 years due to its low cost of operation compared to HDD. Eventually, this cost is expected to decrease, becoming cheaper than HDDs. However, some manufacturers have shared concerns over the stability of the raw material supply chain.

While there are no current tangible direct impacts, it is prudent to stay alert as this segment may also become susceptible to these ongoing issues.

FINISHED PRODUCTS

Demand for webcams

Logitech webcam supply remains tight, particularly for the C310 model. Vendors reported that they did not receive much stock in the last two months of 2020. Supply for lower-end models, such as C270, B525 and C525, are also experiencing shortages.

In contrast, availability for headsets is healthy, except for H111, which are in critical shortage and has no firm lead times from manufacturers.

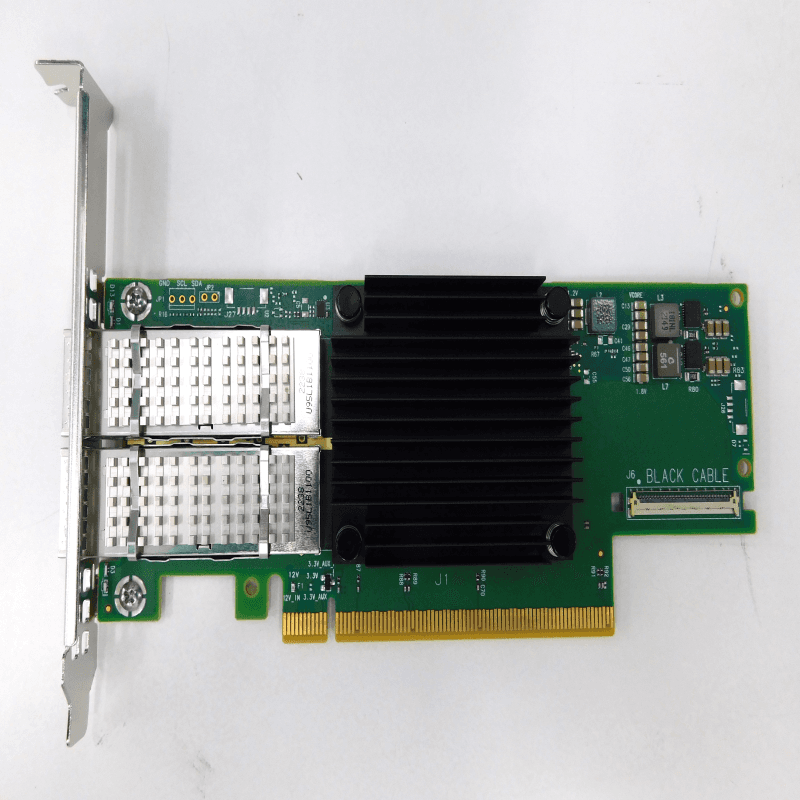

Wi-Fi modules in demand

There is increased demand for Wi-Fi modules due to the hot PC market, causing supply to worsen across all Intel WLAN and Wi-Fi cards in Q1. Wi-Fi production has been stunted from competing with the IoT and 5G segments for 28nm wafers, which is required in many components. This includes CMOS sensors, RF components and Bluetooth chipsets.

The most affected Wi-Fi modules are AX200 and AX201. Demand for the AX200, specifically, has surged and prices have increased by up to 30% since early December. Due to additional supply issues, such as with LCD panels, some customers have delayed taking on stock.

Distributors are warning that pricing is likely to remain high and may even increase if supply for other components remain constrained, leading customers to turn to the open market for Wi-Fi modules.

Increased LCD demand

Like many areas in the technology industry, LCD supply has continued to be tight. Offers for all sizes are limited, with the exception of 15.6-inch screens, which occupies the largest proportion of manufacturers’ production capacity and whose lead time is around two weeks.

There is noticeable demand with corresponding price premiums for 13.3-inch and 17.3-inch LCDs from the service market.

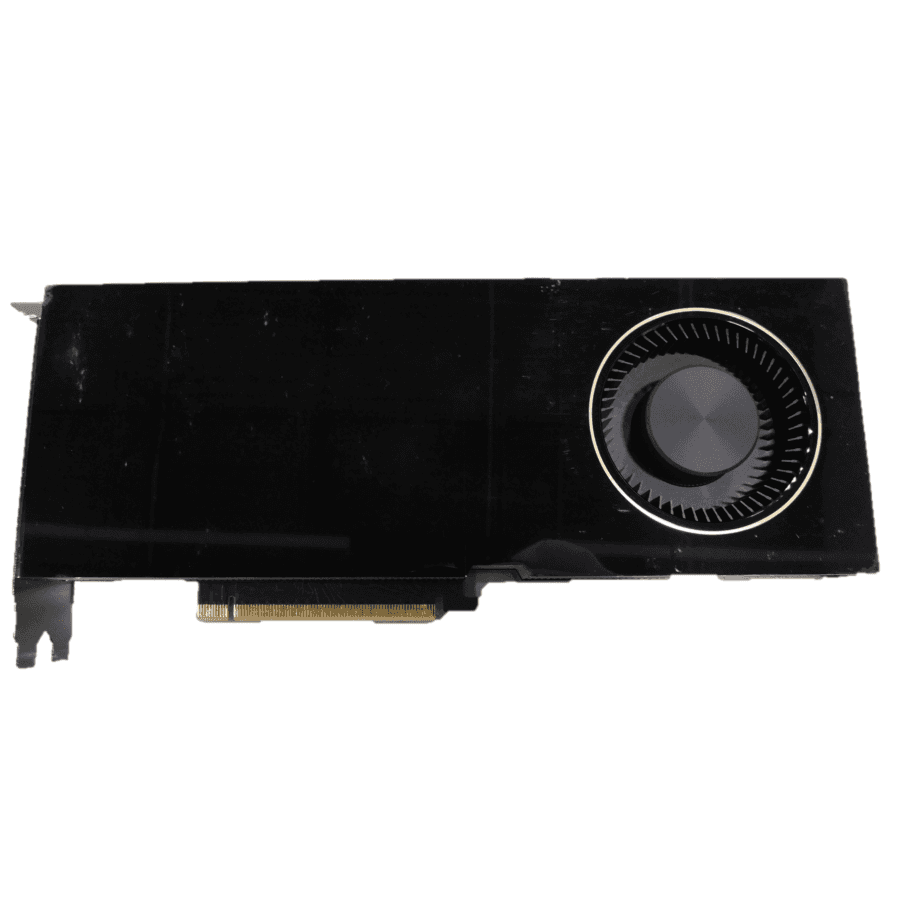

GPUs

GPU pricing at a high as companies face shortages

Nvidia’s RTX 30xx series GPUs generated strong interest and demand in the second half of 2020, which remains strong. However, Nvidia has encountered production issues due to unsatisfactory yields of the 8nm wafers at its foundry partner, Samsung. Furthermore, the general raw materials shortage and price increases (e.g., PCB boards and GDDR6 memory chips) are also affecting Nvidia and other GPU manufacturers.

Manufacturers have increased official pricing on and are passing the additional cost onto distributors. Nonetheless, open market pricing is exceeding official pricing due to tight allocation and limited product availability. Regarding US-based customers, the exemption of China-made GPUs expired on Dec. 31, 2020, and was not renewed, leaving these products with an additional 25% tariff.

Cryptocurrency activity leads to market growth

As predicted, the bull cryptocurrency market has led to a noticeable increase in mining activity. Due to poor availability of the new RTX 3000 series, many miners are using older generation GeForce cards, such as the RTX 2060, GTX 1650 and GTX 1660. The supply of these cards is limited, and prices are on the rise.

In response to the increase in mining activity, AMD has opted for a different strategy and is supplying cryptocurrency miners directly instead of through its traditional manufacturing and distribution partners. This has left many AMD distribution partners short on models, including the RX570, RX580, RX5700 and RX5800. This is in addition to the shortages caused by the introduction of the PS5 last year.

AMD to announce end-of-life on RX500 series

AMD is expected to announce the end-of-life on the RX5000 series in an attempt to push demand toward its newly launched RX6000 series, despite the limited supply of new models. Stock availability and pricing for the RX5000 series isn’t expected to recover. AMD may opt to offer the remaining stock as part of larger product packages (e.g., including motherboards) rather than standalone GPUs to maximize revenue and profit.

In the upper end of the GPU market, enterprise users have begun switching over from Tesla’s older generation V100 to the newer A100 cards. This was offset by 16GB V100 going end-of-life as of December 2020. The 32GB version is expected to follow suit by the end of Q1.