The Greensheet is Fusion Worldwide’s monthly report on trends that impact the supply chain and open market. Check out our latest semiconductors, finished goods, and hardware components report.

Here are some highlights from the June Greensheet:

- Shortages continue for Renesas and NXP’s automotive integrated circuits.

- Demand spikes for TDK’s PTC Thermistor sensors and shortages may soon follow.

- Intel’s chipset prices have increased; driving customers to seek cost savings.

- Spurred by an increase in demand for DDR5, the memory market begins its long-overdue recovery.

- Further delays are affecting the already constrained supply of industrial and consumer-grade fans.

Overall, shortages continue to plague the automotive industry while lead times for industrial products extend beyond 52 weeks, with price increases lurking around the corner. To learn more, read the complete report below.

Demand and Lead Times Increase for Automotive Integrated Circuits

Market conditions are stabilizing for Renesas series, mainly for common series, as lead times have returned to a standard window of 16 – 24 weeks. However, demand is pushing lead times higher for automotive series. Shortages of image sensors, MOSFETs and transistors persist.

Due to the activity in the automotive market, Renesas is prioritizing orders for the R5# and R7# MCU series, as these are primary market drivers. They have also been experiencing shortages for some time, alongside the R5F, ISL and PS series. Lead times for Renesas are as follows:

- PS- prefixed optocouplers are out of stock, with lead times unavailable.

- Switch regulators, 8-bit and 32-bit MCUs, see lead times come down to about 40 weeks.

- M3026XX and M3062XX lead times are over 52 weeks, and specific micro-controller production capacities remain constrained.

NXP is experiencing similar constraints for its automotive series. Lead times for the MCIMxx series are unstable and stretch up to 70 weeks. Meanwhile, the automotive-grade MCU series FSxxx is at least 52 weeks. Pricing is also rising for the S9x series, which faces severe shortages.

For the general-purpose amplifier 2 circuit 9-PDIP series, limited manufacturing allocation in Malaysia is behind the constraint. This is due to a surface electroplated interconnection pattern (SEIP) issue, which can cause electrical malfunctions or failures. Fortunately, the company has allotted substantial production capacity to fulfill demand, so the supply imbalance should be short-lived. However, this has affected all newly placed orders, and customers could see lead times and delivery timeframes extend.

TDK's High-Precision Sensors Take the Spotlight

TDK Corporation plans to double its output of automotive high-precision sensors to ensure sufficient supply. Efforts to safeguard allocation for the automotive industry benefit both automotive customers and TDK, as automotive was hit particularly hard during the pandemic by shortages of integrated circuits and other electronic components. This strategy will strengthen strategic partnerships with TDK and its customers, while the advanced production technologies will improve overall manufacturing for all of TDK’s additional verticals.

These sensors play a crucial role in automotive applications by providing accurate and reliable measurements for various parameters such as pressure, temperature, humidity and location. As vehicles become more technologically sophisticated, the need for high-precision sensors soars. These sensors are essential for enabling advanced driver-assistance systems (ADAS), improving vehicle safety, and enhancing overall performance.

Automotive and Consumer Markets Seek Enhanced Temperature Sensing Products

The automotive and consumer industries are increasing demand for PTC thermistors because of their numerous temperature monitoring applications. While the automotive industry uses these sensors to prevent engine overheating, the consumer industry is leveraging them in smartphones and wearables to ensure the safety and longevity of electronic devices.

Driven by the mounting need for temperature sensing, thermal management, and protection in various industries, PTC thermistor sensor demand will likely continue to increase.

CPU

Cost Savings Remains Top Priority for PC Customers

Life is slow for Intel’s 12 Gen Alder Lake and 13th Gen Raptor Lake desktop and mobile CPUs. Cost savings are key for driving conversations with customers and remain the main topic in the open market.

Intel is offering special pricing directly to OEMs to manage numbers during the recent downturn in business. However, authorized distributors have yet to receive similar discounts.

AMD’s strategy has been to provide direct support for Tier 1 customers while distributors rely on the Tier 2 customers to maintain target revenue. As a result, fulfillment for Tier 2 customers is doing well, considering it is a secondary focus for manufacturers. In particular, AMD Mobile CPU sales have been adequate, markedly for the Ryzen 6000 and Ryzen 7000 series.

AMD also strategically targets the AI industry following the recently launched Ryzen 7000 mobile APU to benefit from the rising demand. As AMD continues to allocate more resources and capacity for AI customers, it will be interesting to see how the newest launch of the 7040 U-series processors performs.

Overstock Challenges Trigger Conservation Forecasts in a Slow Server Market

Following a poor quarterly revenue report, Intel is accommodating Tier 1 users with favorable pricing and supply to improve its business outlook. There were rounds of price surveying but no significant transactions, and sales have decreased over the past month.

Inquiries for the latest Intel Sapphire Rapids server CPU are minimal, indicating that adoption is slower than the prior transition period from Cascade Lake to Cascade Lake Refresh. Authorized distributors hold conservative forecasts for Sapphire Rapids, and special pricing is not easily approved. There has also been no news of rebates incurred on the series, which has not helped demand.

Demand is in a similar slump for AMD’s 4th Gen Genoa series. As a result, vendors are maintaining cautious forecasts to avoid overstock challenges. In addition, inventory backlogs on the previous two series of Milan and Rome remain concerning, and pricing is on a downtrend.

However, the AI industry could spur server market recovery as buyers look to Intel and AMD for CPUs. As more businesses incorporate AI services into their workstreams, the potential for AI demand should only go up.

Chipset Prices Increase; Will Demand Change?

Intel's ten percent increase in server chipset prices came as no surprise, considering how open market demand has been trending upward lately. Customers increasingly sought transactional pricing throughout May to secure supply before the increase. However, limited availability only pushed pricing higher, so cost savings opportunities were minimal.

In particular, chipsets like the C621 have seen a concentrated order rise because of their compatibility with the popular Cascade Lake Refresh and Cascade Lake CPUs. The C621A component saw a similar escalation in inquiries because it is used for the 3rd Gen Ice Lake.

The price increment included the server chipset C741, compatible with the latest Sapphire Rapids. Unfortunately, the adoption rate for this CPU has been low and could drop further as customers delay transitioning from the previous generation Ice Lake. The desire for cost efficiency is prolonging the shift.

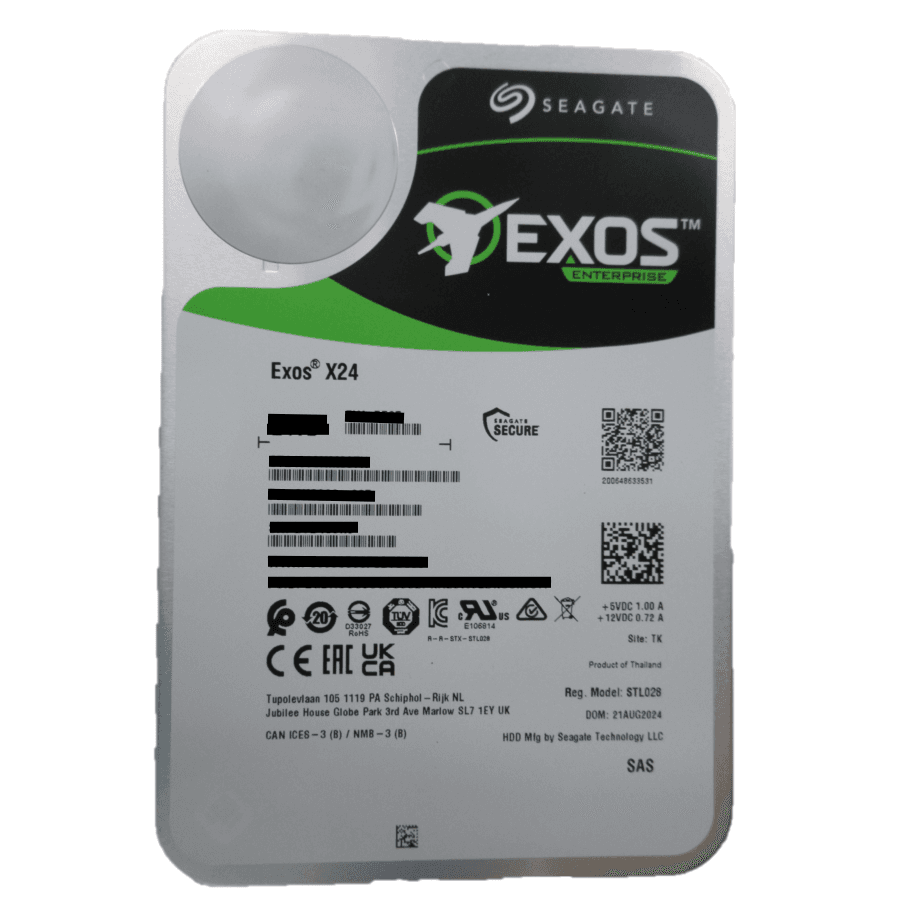

Low Demand and Heightened Supply Lead to Production Cuts for SSDs and HDDs

Low-capacity SSDs, such as the 240GB – 480GB, have seen pricing hit rock bottom as demand remains soft. Difficult market conditions and shrinking profit margins have pushed manufacturers to cut production for lower-capacity SSD and all HDD lines. Seagate has already initiated production cuts and is also reducing its workforce.

Open market supply is currently healthy, and even with reduced output from manufacturers, it will likely be some time before manufacturers work through inventories.

Suppliers admit that higher capacity and enterprise HDDs are the only bright spots for inquiries and orders. However, supply is healthy, and production cuts will have little impact on these products. Furthermore, supply has diminished for Intel's S4510 series, which went EOL in October 2021. Manufacturers encourage distributors and end customers to transition to the S4520 now to guarantee supply before the EOL series becomes completely unavailable.

Memory Manufacturers Focus on Preventing Price Erosion as Market Recovers

Activity within the RDIMM market has increased over the past month after manufacturers made production cuts. This tactic caused an uptick in orders for specific high-runners, momentarily raising prices, but costs are now stabilizing after the initial rush.

Furthermore, an issue with power management integrated circuits (PMICs) has impacted the supply of DDR5 memory modules, causing pricing to trend higher. While manufacturers tried to correct the problem quickly, the setback is lingering for Samsung RDIMMs. Samsung was able to resolve the PMIC issue for 64GB 5600 DDR5. Remaining inventory constraints are mostly isolated to the 256GB, but overall supply has yet to return to normal levels. Recovery will likely take another two to three months.

As market conditions improve, manufacturers are concentrating on balancing supply with demand to prevent more price erosion and fluctuations. Forecasts indicate that DDR5 demand will continue to swell in the second half of 2023 into 2024, so companies will likely focus their production investments on supporting this market.

For PC DIMM, vendors are starting to feel the results of the supply reductions over the last several quarters. Open market prices have gone up by at least ten percent, mostly for 8GB and 16GB modules.

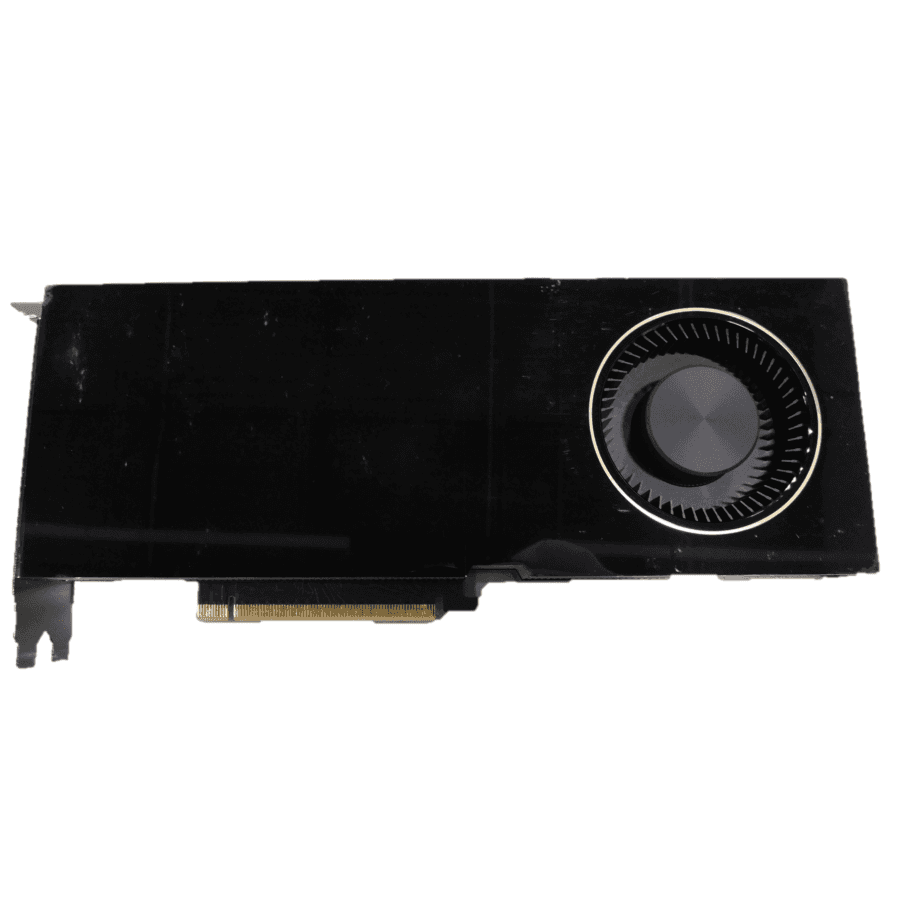

Lengthy Lead Times Earn Enterprise GPUs Priority Over Gaming GPUs

Despite healthy demand for NVIDIA's RTX 4090, supply is limited. This is primarily the result of insufficient support for GPU chipsets, as manufacturers may be prioritizing allocation for enterprise GPU production. This situation could worsen with the June launch of the new RTX 4060ti and 4060ti 8GB models.

While gaming GPU business is steady, enterprise GPUs are the most sought-after products and official pricing has risen for professional series. Pricing for the Quadro series, used in AI applications, has increased by 10 to 20 percent.

The Tesla GPU is also hot in the open market, and pricing has risen by five to ten percent and continues to move upwards. Stock availability is sparse, especially for the high-end series, and booking lead times have extended by two to three weeks.

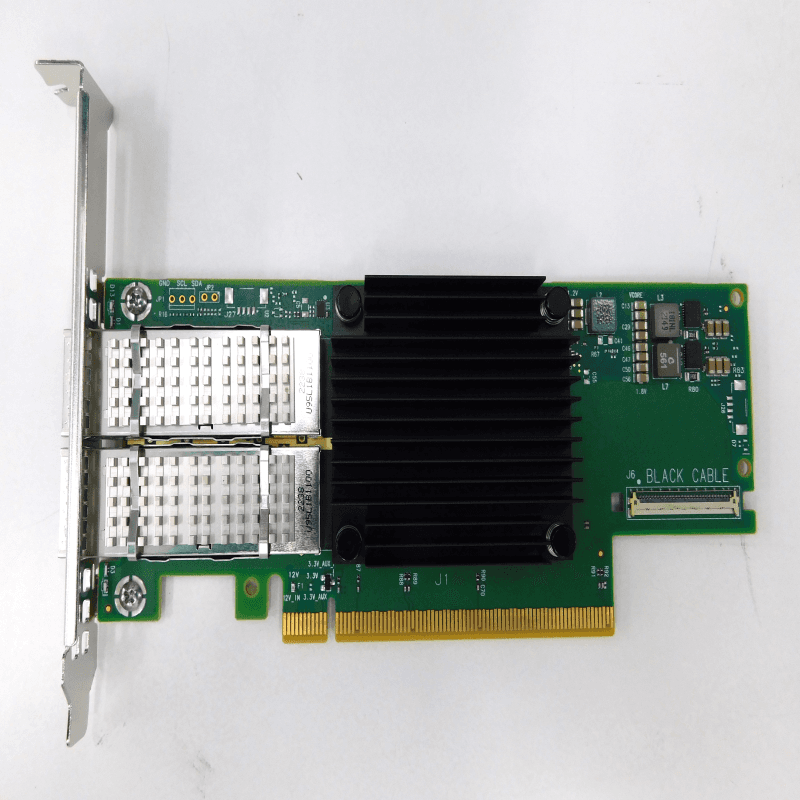

AI and High-Performance Computing Cause Constraints for Certain Networking Products

Overall supply for Ethernet adapter cards is healthy and current pricing is on a downtrend as demand is soft. However, optical cable products and high-speed switches are hot in the market, which likely stems from customers using the components for high-performance computing and AI applications. The heightened interest has caused open market supply constraints.

Most high-speed switch lead times are at least 30 – 40 weeks but are forecasted to expand in the coming months, thanks to a surge in networking projection and the continued development of AI technology worldwide. Networking product forecasts are highly optimistic and predict that the industry will continue to grow throughout the year.

Industrial Product Lead Times Extend Up to a Year

Brands such as Beckhoff, Phoenix Contact, and Rockwell are experiencing shortages of industrial products. Lead times have consequently extended as manufacturers struggle to secure components necessary for production alongside constrained allocation. Additionally, rising costs of raw materials have only caused the supply situation to worsen.

Lead times have now stretched to 26 weeks at best and a year at worst. Price revisions will likely be announced in June, although there has been no confirmation on which products will be affected and to what extent costs will increase.

Extensive Order Backlogs Plague Industrial and Consumer Grade Fans

A lack of raw production materials has led to unstable lead times across all industrial and consumer-grade fans. Fan manufacturers like Sanyo Denki and Delta have been experiencing supply constraints for some time. As a result, order backlogs have progressively inflated across the industry, extending lead times as manufacturing capacity tries to keep up with orders.

Particular series of fans now have booking lead times over 52 weeks, and customers who are still waiting on shipment confirmation may see further delays.