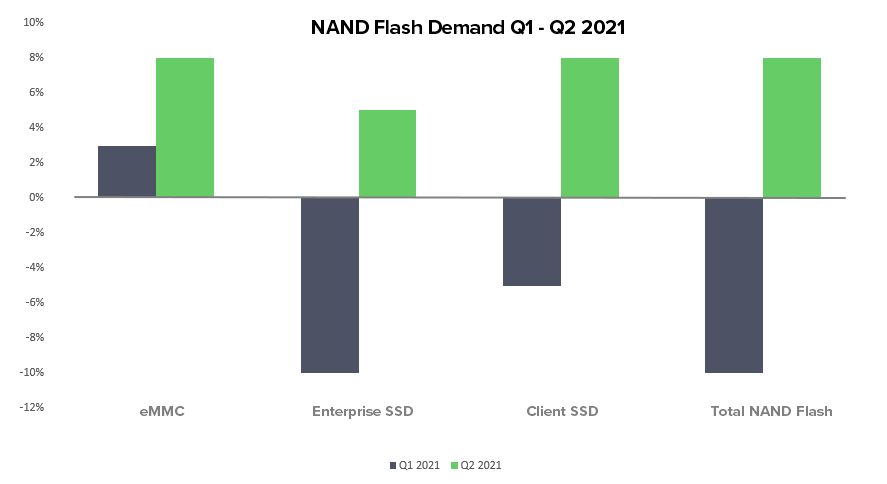

NAND Flash memory is in high demand across commodities as manufacturers like Samsung, YMTC, SK Hynix and Intel rush to expand production capacity. As of mid-March, Samsung's Line S2 fab in Austin was not yet up to full production after the Feb. Texas winter storm, leaving NAND Flash controllers at risk of further constraint. As a result, current projections include NAND Flash pricing increase 3-8% QoQ in early 2021. It's anticipated prices will continue to increase in the second half of the year.

For SSDs and embedded multi-media cards (eMMCs) in particular, NAND Flash is affecting pricing and supply. eMMC products under 32GB feature 2D NAND or 64L 3D NAND are seeing price increases already, which are production categories currently being reallocated toward other industries or scaled down to meet other demands at the fabs. Pricing is rising at least by 3-8%, in line with NAND Flash, for the foreseeable future.

eMMC applications include portable mobility devices, low-end tablets, home appliances, Smart TVs, networking or switching boxes, set top boxes, and more. eMMC pricing will likely remain high for the second half of 2021, as the worldwide chip shortage affects increasingly more commodities and components.