As the CY24 Q4 earnings season concludes, insights from leading companies reveal a landscape shaped by shifting automotive trends, industrial sector realignments, and ongoing supply chain challenges. Looking ahead, industry leaders provide mixed expectations for 2025, offering a blend of optimism, caution, and strategic pivots to navigate market dynamics.

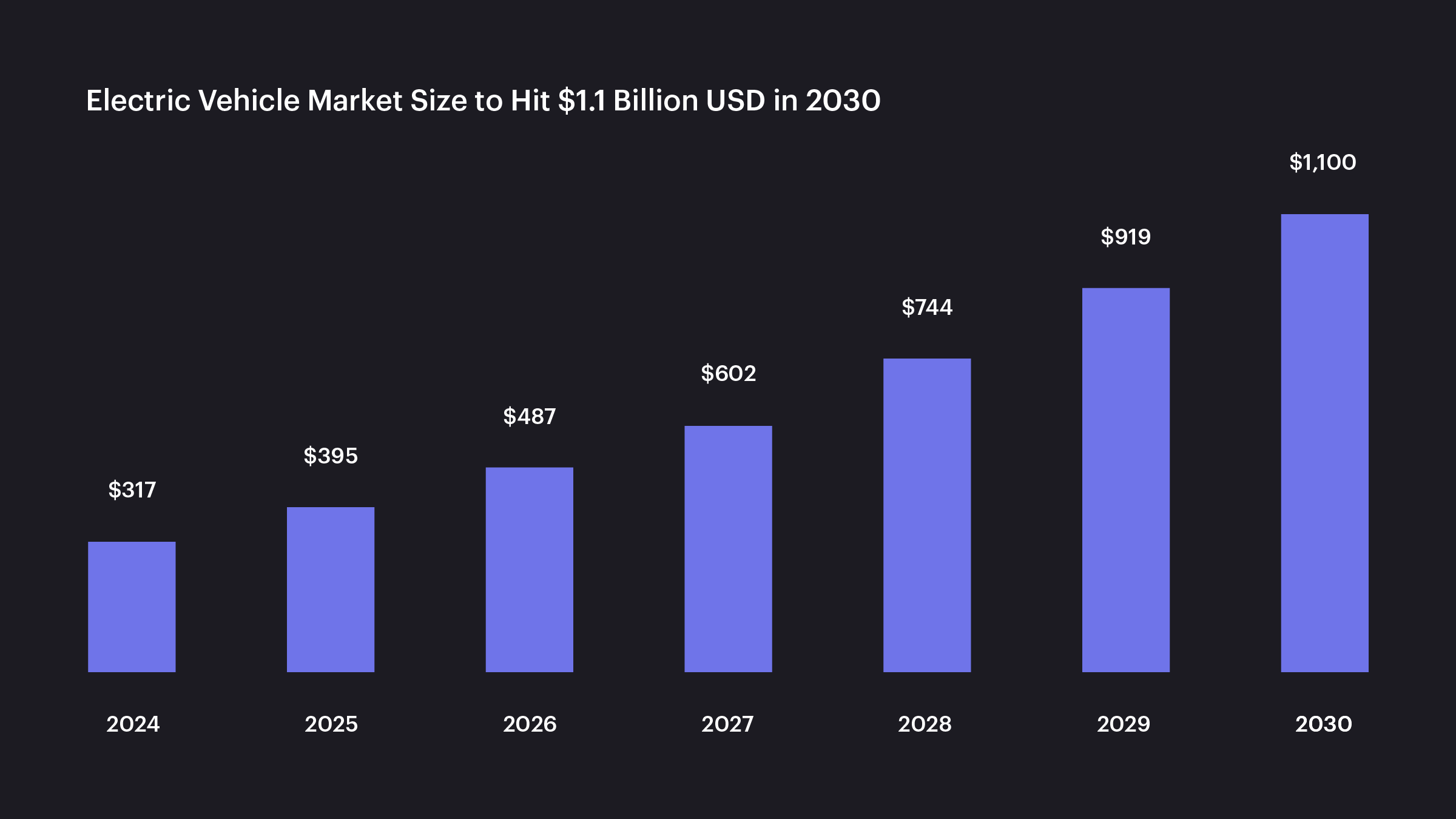

Automotive: EV Growth Offsets Broader Automotive Slowdown

The automotive industry remains in flux and transition, experiencing varying trends across OEMs, Tier 1 suppliers, and semiconductor manufacturers, while strong momentum in EVs and ADAS offsets weaker demand in traditional vehicles

- OEMs Adapting to Market Pressures: Leading automakers, including Toyota and Volkswagen, highlight resilience in EV adoption but caution against supply chain uncertainties and raw material cost fluctuations.

- Tier 1 Suppliers Facing Margin Pressures: Companies like Bosch and Valeo report strategic price adjustments to offset rising material costs and tariffs.

- Semiconductor Shortages Easing, But Not Over: Tier 1 chipmakers such as NXP and Infineon indicate improvements in supply chain constraints but emphasize ongoing demand-supply mismatches in critical automotive components.

- SiC Technology Sees Rapid Expansion in EV Applications: Silicon Carbide technology is gaining significant traction in EV powertrains, charging, and power management with companies like Wolfspeed and ON Semiconductor seeing substantial growth.

- Supply Chain Diversification Amid Geopolitical Tensions: Companies are diversifying production to mitigate supply chain risks arising from US-China geopolitical tensions.

Source: https://www.precedenceresearch.com/electric-vehicle-market

Growth Drivers: Electric vehicles (EVs), advanced driver-assistance systems (ADAS), and increased semiconductor content per vehicle.

Challenges: Inventory digestion, demand softness in certain regions, and geopolitical tensions.

Outlook: Continued growth in EV and ADAS markets, with significant adoption of silicon carbide (SiC) technology. Recovery expected in the second half of 2025 as inventory levels normalize.

Executive Insight: “Tariff costs will need to be compensated by carmakers as auto suppliers cannot alone absorb or even share their burden."

— Christophe Périllat, CEO of Valeo

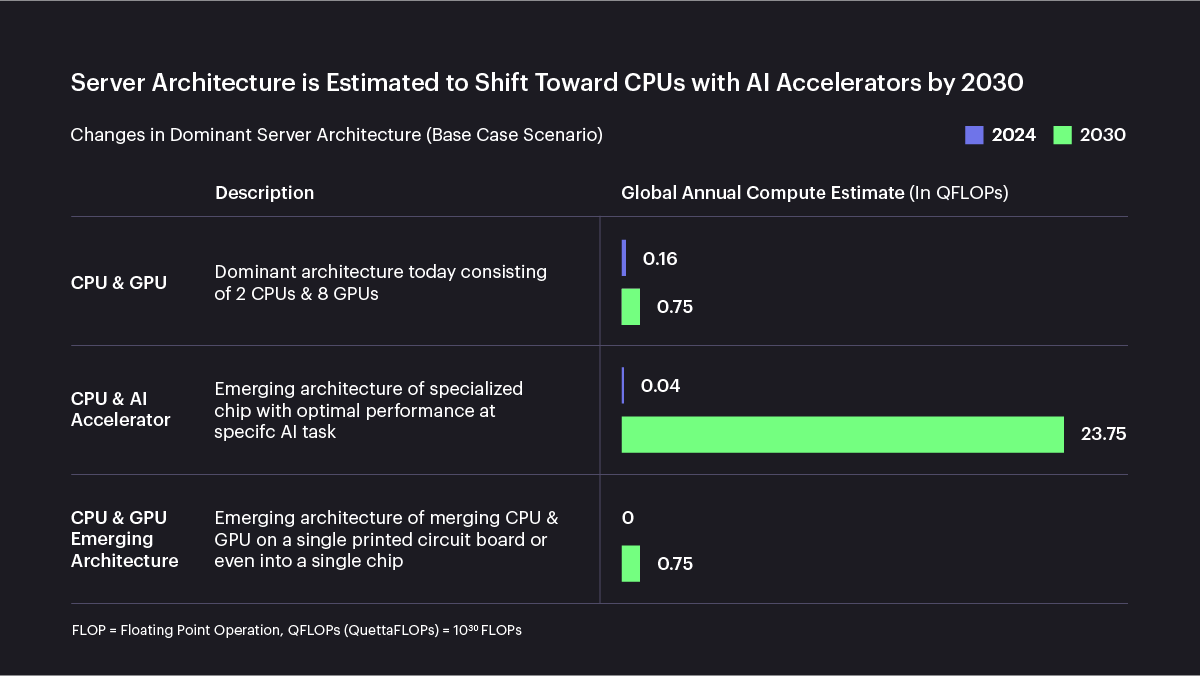

AI and Data Center: Sustained Momentum in AI Infrastructure

Demand for AI-driven components remains a critical driver of growth, with investments in cloud computing, high-bandwidth memory (HBM), and advanced semiconductor nodes maintaining upward momentum.

- Strong AI Compute Demand: There's a surge in demand for AI accelerators and high-performance computing chips from companies like NVIDIA, AMD, and TSMC.

- Cloud Providers Driving Infrastructure Expansion: Amazon, Microsoft, and Google increase spending on AI-ready data centers and networking.

- Growing Memory and Storage Needs: The demand for high-bandwidth memory (HBM) and solid-state drives (SSDs) is increasing, benefiting companies like Micron and SK Hynix.

- Expansion of Data Center Connectivity: Investments in data center interconnects and high-speed networking solutions are rising, as seen by Cisco and Broadcom's growth.

- Increased SiC and GaN Adoption for Power Management: Silicon carbide (SiC) and gallium nitride (GaN) technologies are being adopted more rapidly for efficient power management in AI servers and data centers.

Source: https://www.mckinsey.com/industries/semiconductors/our-insights/generative-ai-the-next-s-curve-for-the-semiconductor-industry

Growth Drivers: AI-driven infrastructure, hyperscaler investments, and high-performance computing.

Challenges: Supply chain disruptions, inventory management, and geopolitical risks.

Outlook: Strong growth expected, particularly in AI accelerators, power management, high-performance memory, and cloud infrastructure. Companies are investing heavily in R&D and capital expenditures to support long-term demand.

Executive Insight: "As AI workloads become more complex and energy-intensive, the importance of reliable SiC JFETs that deliver high energy efficiency and are able to handle high voltages will continue to increase."

— Simon Keeton, Group President, Onsemi

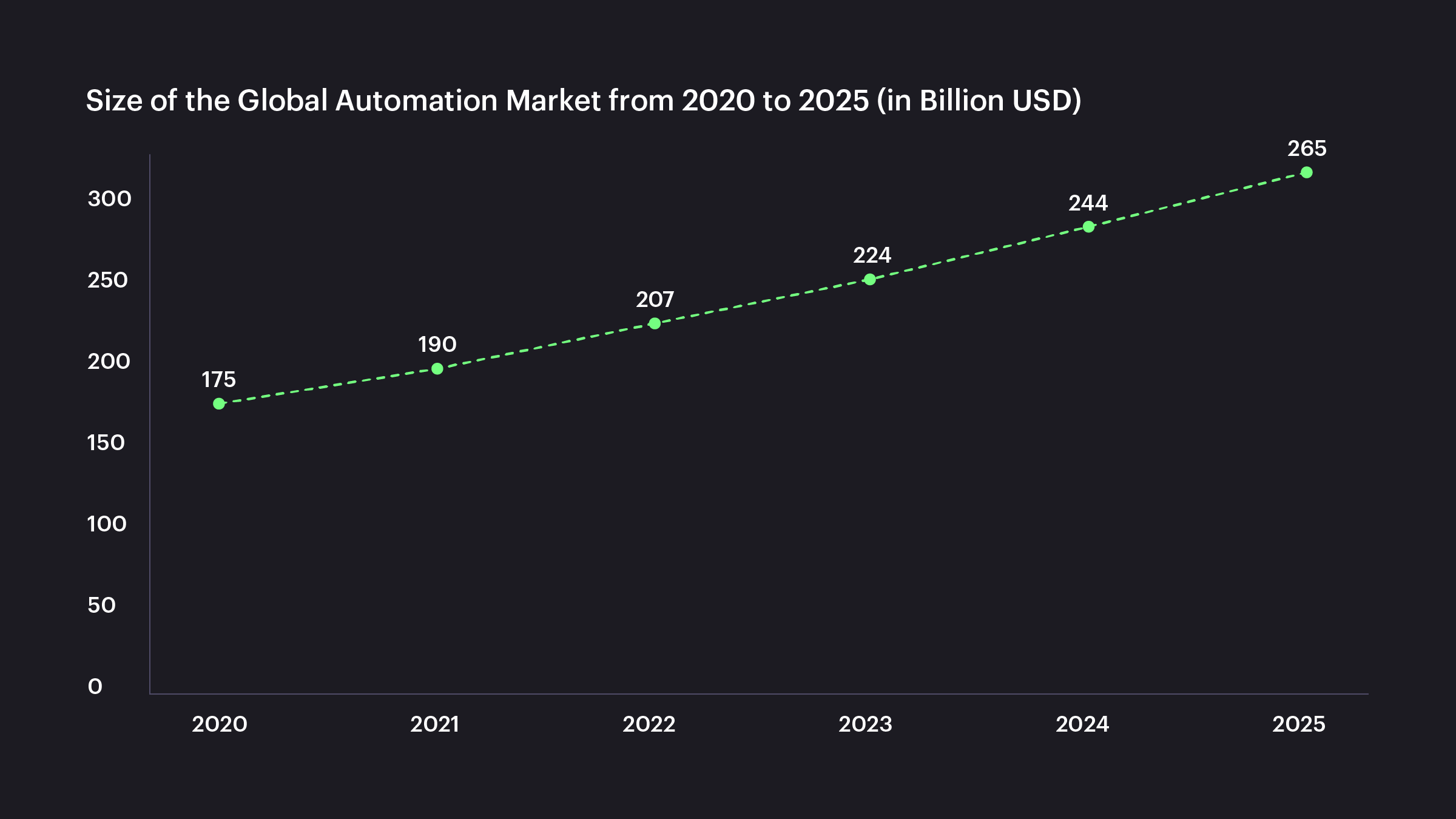

Industrial Automation: Inventory Adjustments and Selective Growth

Industrial markets continue to experience divergent trends, with some areas rebounding while others struggle with prolonged downturns.

- Factory Automation and Heavy Equipment Facing Headwinds: European markets remain weak, with sluggish demand in automation and industrial machinery.

- Bright Spots in Alternative Energy and Aerospace: Companies such as TE Connectivity and Amphenol report strong demand in renewable energy and aerospace applications.

- Inventory Adjustments Drive Recovery Expectations: Texas Instruments and Avnet expect gradual recovery in H2 2025, contingent on inventory stabilization.

Source: https://www.statista.com/statistics/1219772/industrial-automation-market-size-worldwide/

Growth Drivers: Industrial automation, IoT applications, and energy-efficient solutions.

Challenges: Inventory corrections, demand weakness in traditional markets, and supply chain disruptions.

Outlook: Gradual recovery expected, particularly in automation and IoT. Companies are investing in R&D and capital expenditures to support long-term growth in these areas.

Executive Insight: “Inventory levels are stabilizing, and we anticipate a return to growth across key industrial end markets in the coming quarters.”

— Rich Templeton, CEO, Texas Instruments

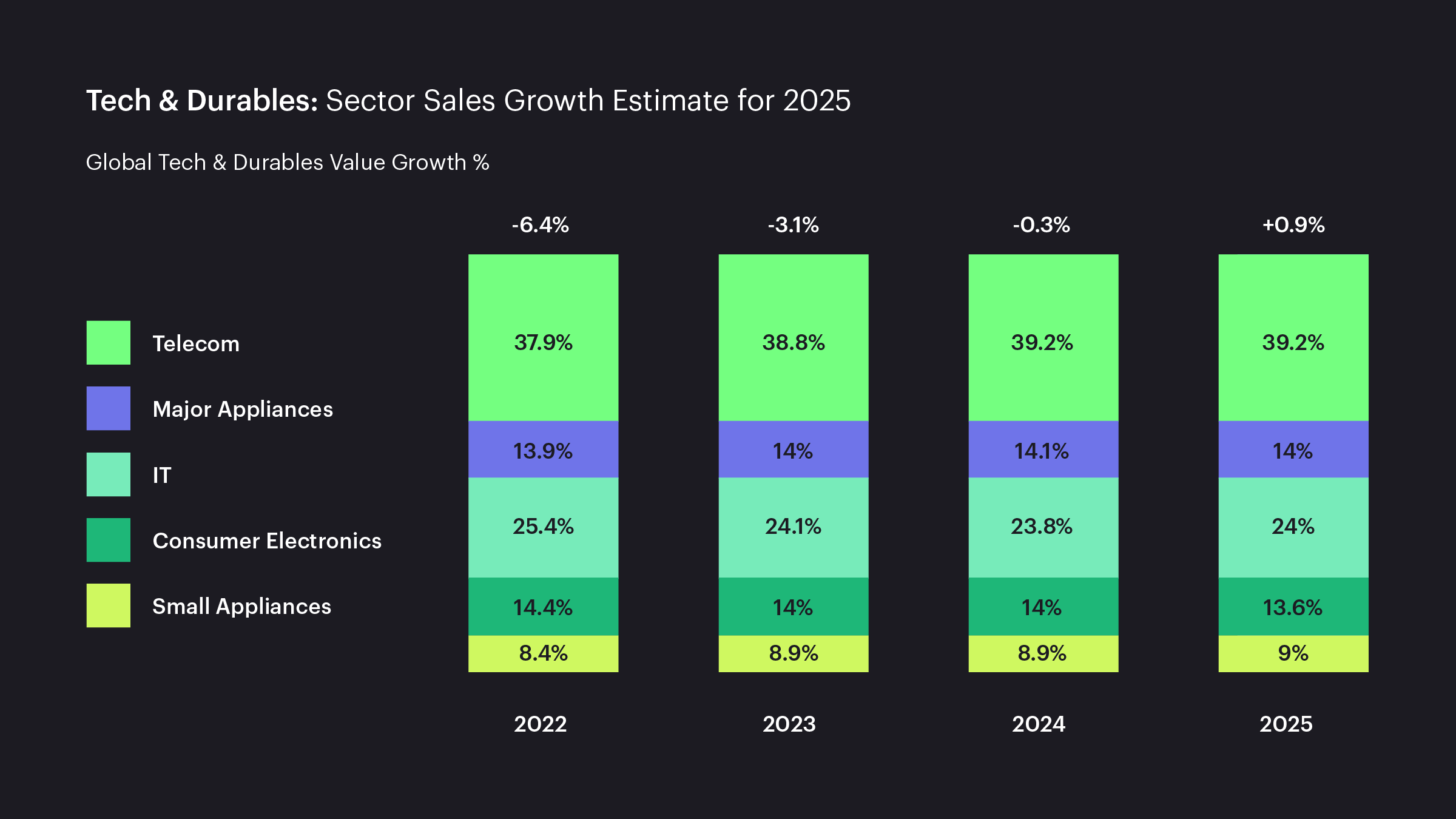

Consumer and Personal Computing: Gradual Recovery with Caution

Consumer electronics and computing markets show mixed trends, with some stabilization but ongoing demand fluctuations.

- PC and Laptop Market Seeing Renewed Interest: Intel and HP report stronger demand as enterprises upgrade IT infrastructure.

- Smartphone Demand Divided: Apple and Samsung highlight growth in premium devices, but mid-range segments remain soft.

- AI-Powered Wearables and Next-Gen Devices Gaining Traction: AI-integrated consumer products continue to drive innovation and new revenue streams.

Growth Drivers: AI-enabled devices, refresh cycles in PCs, and integration of AI in consumer electronics.

Challenges: Inventory overhang, soft demand in traditional consumer electronics markets, and pricing pressures.

Outlook: Gradual recovery in demand, particularly for AI-enabled laptops and tablets. Companies are focusing on cost optimization and operational efficiencies to mitigate challenges.

Executive Insight: “The PC market is showing early signs of stabilization, driven by enterprise upgrades and AI-powered computing demand.”

— Pat Gelsinger, CEO, Intel

Outlook for 2025: A Tale of Two Futures (and a Cautious Middle)

The semiconductor industry presents a mixed bag for 2025. While some companies are brimming with optimism, fueled by the explosive growth of AI and EVs, others are bracing for continued headwinds.

Here's a look at the key trends:

The Optimists: Riding the AI and EV Wave

- AI Dominance: Companies like TSMC, AMD, and Amphenol are betting big on AI. They foresee massive growth in AI accelerators, data center infrastructure, and high-performance computing chips. TSMC's confident outlook is clear: “For 2025, we anticipate continued robust demand from AI-related applications, projecting overall revenue growth in the mid-20% range year-over-year. AI accelerator revenue, comprising GPUs, ASICs, and HBM controllers, more than tripled in 2024 and is expected to double again in 2025.” Amphenol also anticipates, “continued demand growth in AI-driven data centers and defense markets, with IT datacom sales projected to increase in the mid-single digits sequentially.”

- EV Momentum: Infineon and Monolithic Power Systems (MPS) are confident in the continued expansion of the EV market, particularly in China, with strong demand for silicon carbide and power electronics. Qualcomm is also seeing a surge in automotive revenues, driven by their Snapdragon platform. Infineon highlights, “Infineon achieved notable design wins, including a major silicon carbide module order from a key Chinese OEM, reinforcing our leadership in the market.”

- Cloud and Connectivity: Amazon's AWS expects double-digit growth, driven by AI cloud services. They report, “AWS demand remains strong, with new generative AI services gaining traction. Same-day delivery and expanded logistics capabilities position Amazon for another strong year.”

- Improving Inventory Digestion: NVIDIA is experiencing robust demand for its AI chips, leading to supply constraints. The company is actively collaborating with suppliers like Taiwan Semiconductor Manufacturing Company (TSMC) to address these challenges. This strong demand suggests that inventory levels are being efficiently managed, with products moving swiftly through the supply chain. NVIDIA highlights "Despite massive interest to build new AI systems with Nvidia's technology, the company can only sell as many chips as its contractor, Taiwan Semiconductor Manufacturing Co (TSMC), can produce."

The Pessimists: Navigating Inventory and Demand Challenges

- Industrial and Automotive Weakness: STMicroelectronics, ON Semiconductor, Microchip Technology, Vishay Intertechnology, and Diodes Incorporated are facing challenges due to inventory corrections and sluggish demand in the industrial and automotive sectors, especially in Europe. STMicro observes, “The Industrial segment was severely impacted, declining 41% year-over-year due to a delayed recovery and inventory correction, particularly in Europe.”

- China Concerns: ON Semiconductor specifically cited factory shutdowns in China as a significant factor impacting their Q1 2025 outlook. They forecast, “Automotive demand weakened into Q1 2025, with a forecasted 25% sequential decline driven by early Chinese New Year shutdowns and extended plant closures from top Chinese automakers.”

- Worsening Inventory Digestion: Texas Instruments (TI) is facing elevated inventory levels, particularly in its automotive and industrial segments. This accumulation has led the company to reduce factory loadings, impacting profit forecasts and indicating challenges in inventory digestion. TI highlights "Elevated inventory levels across these markets drove TI to reduce factory loadings... Inventory at the end of the fourth quarter was $4.5 billion, up $231 million from the previous quarter.

The Cautious Middle: Balancing Growth and Uncertainty

- Mixed Signals: Companies like TE Connectivity, Arrow Electronics, Renesas Electronics, Samsung Electronics, NXP Semiconductors, and Skyworks Solutions are taking a more balanced approach. They acknowledge growth opportunities in areas like AI and automotive, but remain cautious about inventory levels, supply chain risks, and macroeconomic uncertainties. NXP points out, “Limited visibility and an increase in turns business add uncertainty to demand forecasting.”

- Regional Variances: Many companies are noting that even within sectors, regional variances are playing a big role. Europe is mentioned many times as a region of concern.

- Improving Inventory Digestion: Bosch's involvement in the joint venture with TSMC, Infineon, and NXP to build a semiconductor fab reflects a strategic approach to future supply chain stability. While this indicates a focus on long-term supply capabilities, it doesn't directly address current inventory digestion statuses. Bosch highlights: "The planned joint venture will be 70% owned by TSMC, with Bosch, Infineon, and NXP each holding 10% equity stake... Total investments are expected to exceed 10 billion euros." Infineon has also diversified its partnerships, becoming a supplier for NVIDIA's GB200 AI GPU server system. This strategic move indicates a proactive approach to inventory management, aiming to balance supply with the growing demand in the AI sector. Infineon mentions "Texas Instruments and Infineon have been officially added as new suppliers for Nvidia... aligning with Nvidia's push towards mass production of its highly anticipated GB200 chip."

For deeper analysis on pricing, demand shifts, and geopolitical developments shaping the electronic component supply chain, download Fusion Worldwide’s latest State of the Industry Report. To stay continuously informed between editions, subscribe to The Greensheet — our monthly snapshot of market-moving trends and procurement intelligence.